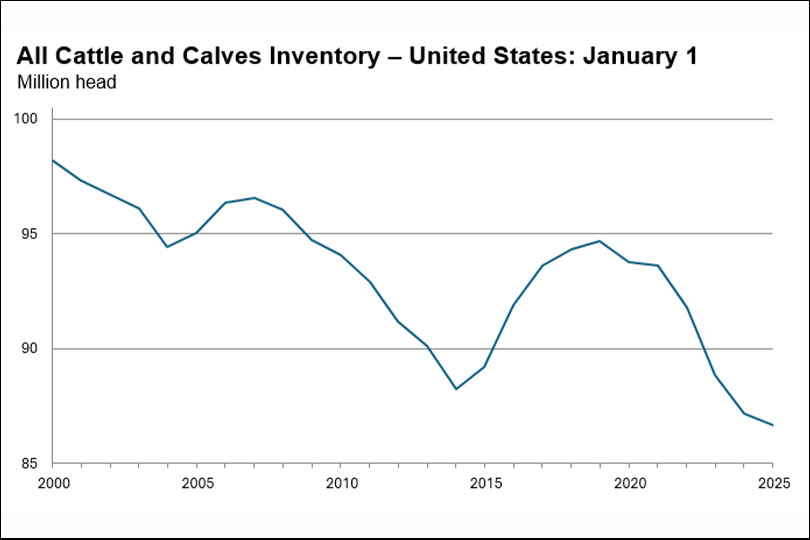

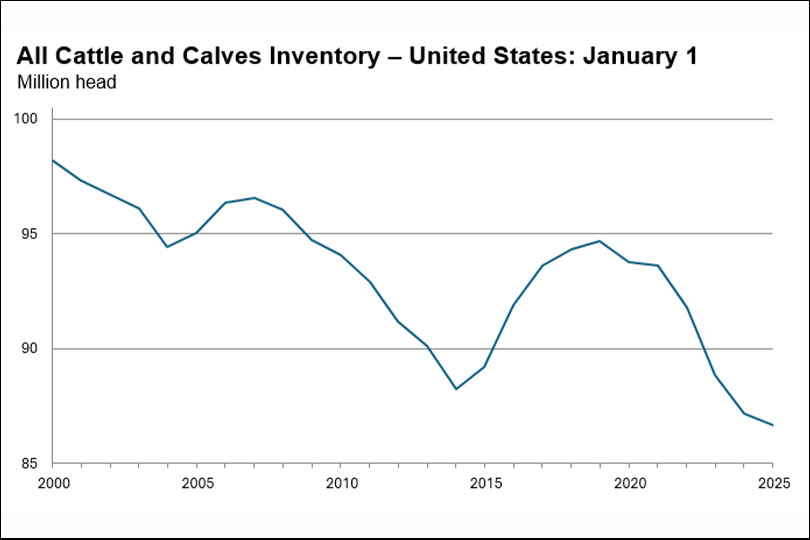

No wonder beef prices are so high!

Texas cattle herd grows slightly, U.S. numbers drop

By Julie Tomascik

Editor

Editor

The latest cattle inventory report shows the Texas cattle herd grew slightly since January 2024, but the overall U.S. herd remains near record low numbers.

In Texas, there were 12.2 million head of cattle, up 2% from last year.

There were 86.7 million head of cattle and calves in the U.S., down 1% from last year, according to the U.S. Department of Agriculture’s annual cattle report.

“Ranchers are faced with tough decisions—retain heifers and rebuild their herds or sell at the higher prices,” Tracy Tomascik, Texas Farm Bureau associate director of Commodity and Regulatory Activities, said. “The next few years should bring good opportunities to Texas ranchers, but input costs and drought conditions still remain a concern.”

Texas cattle numbers

At 12.2 million head, Texas continues to rank first in the nation in the total number of cattle and calves, accounting for 14% of the total U.S. inventory.

At 12.2 million head, Texas continues to rank first in the nation in the total number of cattle and calves, accounting for 14% of the total U.S. inventory.

The total inventory of all cows that calved in Texas was 4.75 million head, 2% above last year’s total.

Beef cows, at 4.08 million head, were up 1% from a year ago.

Milk cows were up in Texas. There are 675,000 head, up 40,000 head from last year.

Inventory of all heifers 500 pounds and over in Texas totaled 2.54 million on Jan. 1, up slightly from 2024. Beef replacement heifers, at 600,000 head, is 6% lower than from 2024. Milk replacement heifers totaled 220,000 head, down 4% from last year

Texas inventory of steers 500 pounds and over totaled 2.57 million head, up 2% from

last year. Inventory of calves less than 500 pounds, at 2.02 million head, is up 1% from last year’s total.

The 2024 calf crop totaled 4.35 million head, 2% higher than the 2023 calf crop.

U.S. cattle numbers

USDA’s cattle inventory report also showed all cows and heifers that have calved were down slightly to 37.2 million.

USDA’s cattle inventory report also showed all cows and heifers that have calved were down slightly to 37.2 million.

Beef cows, at 27.9 million head, were down 1% from a year ago.

All heifers 500 pounds and over as of Jan. 1 totaled 18.2 million head, 1% below the 18.3 million head last year. Beef replacement heifers, at 4.67 million head, were down 1% from a year ago.

Other heifers were down 1%, totaling 9.59 million head.

Milk cows, at 9.35 million head, were up slightly from the previous year. Milk replacement heifers were also down from last year, totaling 3.91 million head.

Bulls weighing 500 pounds and over were down slightly. They totaled 2.01 million head on Jan. 1.

Steers weighing 500 pounds and over as of Jan. 1 totaled 15.8 million head, a 1% drop from last year.

Cattle on feed

Cattle and calves on feed for the slaughter market in the U.S. for all feedlots totaled 14.3 million head. That’s down from last year’s 14.4 million total.

Cattle and calves on feed for the slaughter market in the U.S. for all feedlots totaled 14.3 million head. That’s down from last year’s 14.4 million total.

Cattle on feed in feedlots with capacity of 1,000 or more head accounted for 82.7% of the total cattle on feed, up slightly from the previous year. The combined total of calves under 500 pounds and other heifers and steers over 500 pounds (outside of feedlots), at 24.6 million head, was slightly below last year’s total.

U.S. calf crop

The 2024 calf crop in the U.S. was estimated at 33.5 million head.

Calves born during the first half of 2024 were estimated at 24.6 million head, down slightly from this time last year.

Calves born during the second half of 2024 were estimated at 8.93 million head, making 27% of the total 2024 calf crop.