Generally low inventory levels plus some increases in manufacturing are going to be leading to higher diesel demand. Add in the big BP refinery problems about 40 miles north of where I live and that spells higher prices for diesel coming our way.

oilprice.com

oilprice.com

U.S. Diesel Supply Tightens As Manufacturing Comes Roaring Back | OilPrice.com

Manufacturing activity in the United States is recovering while distillate inventories remain below the five-year average, pointing to a tightening in the diesel market.

US Diesel Supply Tightens As Manufacturing Comes Roaring Back

By Charles Kennedy of OilPrice.com

U.S. manufacturers are recovering from an extended slump in activity and their energy consumption is about to start rising, with the risk of tightening an already tight diesel market.

Reuters market analyst John Kemp reported the index for manufacturing activity had improved to 49.1 for January from 47.1 in December. The latter figure was the highest since October 2022, Kemp noted in his report, adding that the trend signaled a return to growth.

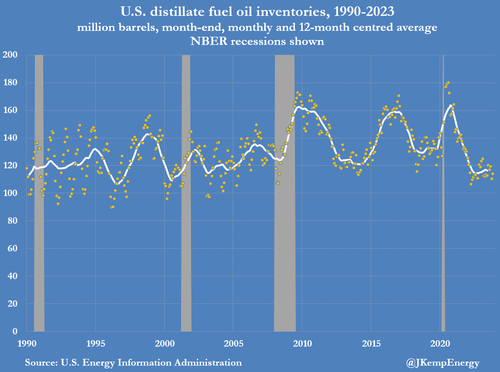

As manufacturing activity improves, however, diesel demand begins to increase in lockstep. This might be problematic in case of a fast recovery because distillate inventories in the U.S. remain below the five-year average, by 5%, per the latest weekly petroleum report of the Energy Information Administration.

The state of distillate inventories, with the total as of January 26 standing at 10 million barrels below the 10-year seasonal average, per Kemp, is better than it was in late 2023. At that time, distillate stocks were 19 million barrels below the 10-year average. Even with the boost in stockpiles, the distillate supply balance remains elusive.

This means that if manufacturing activity continues to improve, it will soon enough lead to higher fuel prices, which would in turn pressure that same manufacturing activity before too long, constraining any growth.

Diesel prices are already on the rise, both thanks to the rebound in manufacturing activity and a refinery outage. BP’s whiting refinery in Indiana—the largest inland refinery in the U.S.—was shut down last week after a power outage. An analyst has said the return to operation could take as little as a week but there is no guarantee it will be so quick. BP has not given any timeline for the refinery’s return to operation.

The outage comes on the heels of several weeks of lower fuel production across the country amid frigid winter weather, Bloomberg noted in a recent report. Supply, therefore, remains precariously close to a shortage.