-

Please be sure to read the rules and adhere to them. Some banned members have complained that they are not spammers. But they spammed us. Some even tried to redirect our members to other forums. Duh. Be smart. Read the rules and adhere to them and we will all get along just fine. Cheers. :beer: Link to the rules: https://www.forumsforums.com/threads/forum-rules-info.2974/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

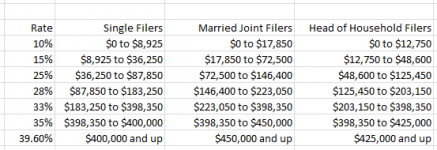

2013 Tax Brackets

- Thread starter squerly

- Start date

Snowtrac Nome

member formerly known as dds

i know except for Big Al there arn't many folks in that 400k and up bracket, but my god taxing damn near half of a guys income sounds criminal

Kane

New member

But just wait until you tack on state taxes, local taxes and property taxes. You'd be left with about 15% of the nut. Makes ya just wanna cry.i know except for Big Al there arn't many folks in that 400k and up bracket, but my god taxing damn near half of a guys income sounds criminal

Or quit working so hard ... or maybe just go on welfare.

.

joec

New member

i know except for Big Al there arn't many folks in that 400k and up bracket, but my god taxing damn near half of a guys income sounds criminal

Just imagine the years it was 90% of the top tear and about 50% on middle incomes in this country. The only difference then was FICA stopped after a set amount but no longer now unless you make over a set amount which is not middle income. So figure that is about 7% for each person drawing a salary and 7% for their employer giver or take a %. In the case of self employed such as me it is the full amount.

squerly

Supported Ben Carson

And then, after you pay all that to just "earn" the money, you have to give up another 7.5 in sales tax when you spend it. My guess is I got to keep about 40% when I owned my software company.But just wait until you tack on state taxes, local taxes and property taxes. You'd be left with about 15% of the nut. Makes ya just wanna cry.

Or quit working so hard ... or maybe just go on welfare.

.

joec

New member

Throw in state taxes in some cases as well as county taxes as here in Lexington. Add the other taxes such as gas, sales, fees for various licenses etc and the Federal taxes seem to diminish in comparison at least for me. My largest tax burden is the state stuff and the feds are not that bad for what I get there.

Snowtrac Nome

member formerly known as dds

well we pay sales tax and gas tax thank god we don't have a state income tax i would be screwed.

BigAl

Gone But Not Forgotten

I once sat down and figured out what I pay in taxes . It hurts ! That was before the increase . I was paying out something like 49% in taxes by the time I added everything in .

My biggest problem is I refuse to have any debt . If I don't own it free and clear than I don't buy it . There was a time ( not so long ago)I could not rub two nickles together and my folks taught me to never put myself in debt . It stuck with me . My financial report is one page . You will not find one debt item anytwhere on it . The down side is my credit score is low because NO ONE knows what I have . That suits me just fine .

My best friend whose is also a tax expert with more degrees than anyone I know of. I once sat down with him and asked him to look over my

portfolio . His reply was that "I was doing everything wrong according to the Tax experts and he would die to be in my place".

So my only option is to build dummy debt or companies to save on taxes and that ain't going to happen .

A.G Edwards Investments actually did a case study on me for new Stock brokers up and coming at their main Office back east . The final conclusion by the teacher was in 15 years of doing the studies he had not ran across anything similar .

I had told him up front nothing would come back on me in a credit report .

I like my privacy . Every time you sign on the line you lose a little bit more privacy .

My biggest problem is I refuse to have any debt . If I don't own it free and clear than I don't buy it . There was a time ( not so long ago)I could not rub two nickles together and my folks taught me to never put myself in debt . It stuck with me . My financial report is one page . You will not find one debt item anytwhere on it . The down side is my credit score is low because NO ONE knows what I have . That suits me just fine .

My best friend whose is also a tax expert with more degrees than anyone I know of. I once sat down with him and asked him to look over my

portfolio . His reply was that "I was doing everything wrong according to the Tax experts and he would die to be in my place".

So my only option is to build dummy debt or companies to save on taxes and that ain't going to happen .

A.G Edwards Investments actually did a case study on me for new Stock brokers up and coming at their main Office back east . The final conclusion by the teacher was in 15 years of doing the studies he had not ran across anything similar .

I had told him up front nothing would come back on me in a credit report .

I like my privacy . Every time you sign on the line you lose a little bit more privacy .

Let's not forget state taxes. In some states it can be as high as 13% on top of the federal taxes.

As for gas tax, don't forget that revenues are going down because fuel economy is going up so Obama's administration has already proposed new ways to tax high mileage vehicles extra for using the roadways on top of the gas tax.

The reality is that only a small portion of your income would have been taxed at very high rates because there were many ways to legally avoid high taxation through various deductions.

Further, high rates only applied to a VERY SMALL NUMBER of tax payers. Now the higher end of the tax rate spectrum applies to a much higher number of people.

As for gas tax, don't forget that revenues are going down because fuel economy is going up so Obama's administration has already proposed new ways to tax high mileage vehicles extra for using the roadways on top of the gas tax.

Joe, while its true that the top bracket was much higher in the past there were lots of different ways to legally reduce your income taxes with what today are called 'loopholes' but back then were very acceptable.Just imagine the years it was 90% of the top tear....

The reality is that only a small portion of your income would have been taxed at very high rates because there were many ways to legally avoid high taxation through various deductions.

Further, high rates only applied to a VERY SMALL NUMBER of tax payers. Now the higher end of the tax rate spectrum applies to a much higher number of people.